ILKLEY has become one of the first towns in the county to have its own digital and physical gift card.

The new Ilkley Town Centre Gift Card is available to buy online as either a physical or digital card, and can be spent with over 50 businesses in the town, including shops, restaurants and services. A sales point will be added in the coming months.

Driven by Ilkley Business Improvement District, the new gift card is part of the BID’s mission to make local shopping easy, cater for how customers shop now and in the future, and help to position Ilkley for a digitally enabled future.

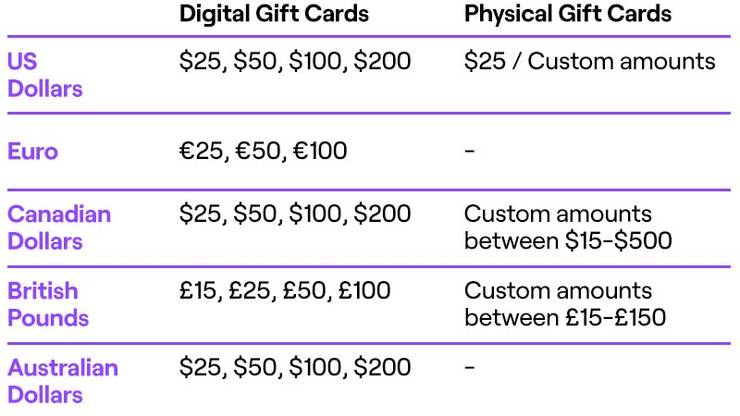

Physical gift cards are sent to the recipient by post with an optional gift message. Digital gift cards are sent to the recipient as a text or email, the recipient can then add the balance of their Ilkley Town Centre Gift Card to their digital wallet and make their purchase using their phone, either online or in-store.

Helen Rhodes BID Manager at Ilkley BID said the introduction of the new gift card will enhance the town’s attractiveness for locals and visitors.

She said: “Gift cards are incredibly popular, with 40% of people purchasing at least one gift card in the past three years. Over 50% of people used gift cards with a new business in 2021, and people typically spend around 65% more when they redeem their gift card. Now, with the Ilkley Town Centre Gift Card, we have a single gift card that can be used right across the town, giving people a local, fun and easy way to shop local. But as well as locals, the Ilkley Town Centre Gift Card can be used by visitors, and by local employers to reward and incentivise their staff. The Ilkley Town Centre Gift Card is a gateway to all that Ilkley has to offer.

“People have the choice between the physical gift card that can be handed over as payment and a digital gift card that can be loaded onto a digital wallet for payment. 27.5% of gift card buyers in 2021 said that they had converted to digital gift cards, vs. 24.2% in 2020. This choice makes the Ilkley Town Centre Gift Card suitable for a wide range of customers.”

A business who has signed up to receive the Ilkley Town Centre Gift Card as payment is Attic Womenswear. Sarah Lyles is the founder of Attic Womenswear, and said: “We can’t wait to see people embracing local life by using the Ilkley Town Centre Gift Card, whether that’s meeting friends for a coffee or meal, or enjoying shopping in one of our many independent boutiques. It’s more thoughtful than a cash gift as it shows that the purchaser has a real pride in our local offering and it’s a great way to support our town. It may encourage people to shop at places they’ve never been before and we’re looking forward to welcoming new customers to our independent boutique in Crescent Courtyard.”

Another business who is set to accept the new Ilkley Town Centre Gift Card as payment is Richard Grafton Interiors. Fran Temperton of Richard Grafton Interiors said the gift card can encourage people to think local first.

She said: “The Gift Card is a welcome initiative to support our town’s economy. The recent Sunday Times article recognising Ilkley as the best place to live in the UK highlights the town’s energetic community spirit, and by actively buying an Ilkley Town Centre Gift Card, it urges people to think local first evoking this loyalty to our community businesses. It’s a powerful way of unlocking spending potential and keeping that money in Ilkley so the more businesses sign up, the better the experience will be. We’re looking forward to accepting the Gift Card at Richard Grafton Interiors with the recipient able to choose from our wide portfolio of services and products.”The Ilkley Town Centre Gift Card can also be spent with services, including salons and hairdressers. Maria Carrera is the Director of Beau Monde Perfumery and Beauty Salon said the new gift card is a welcome initiative.

She said: “By giving an Ilkley Town Centre Gift Card to friends and family, it encourages them to explore everything that Ilkley has to offer, like the vibrant independent retailers and service providers. We’re delighted to be part of the scheme and at Beau Monde the gift card can be used on a fantastic range of treatments or luxury perfumes and products, or both, making it the perfect present. The pandemic was hard for our businesses so this is a great way to encourage people to shop local and bolster the economy.”

The initiative has been funded following a grant from Bradford Council through the Additional Restrictions Grant scheme. The Ilkley Town Centre Gift Card is part of the award winning Town & City Gift Cards programme from fintech Miconex and joins 7 other programmes in Yorkshire: Barnsley, Bradford, Halifax, Harrogate, Scarborough, Sheffield and York.

Colin Munro is the managing director of Miconex: “Ilkley’s new digital and physical gift card gives customers ultimate choice and convenience. Two thirds of people are looking to make gift cards more usable by storing them in their mobile wallets. By 2023, a mobile phone will be the main payment method for 12 million UK customers. This isn’t just about how customers shop today, but how they’ll shop tomorrow.”

Original post:

Ilkley leads the way in the digital high street revolution with the launch of its new gift card